About:

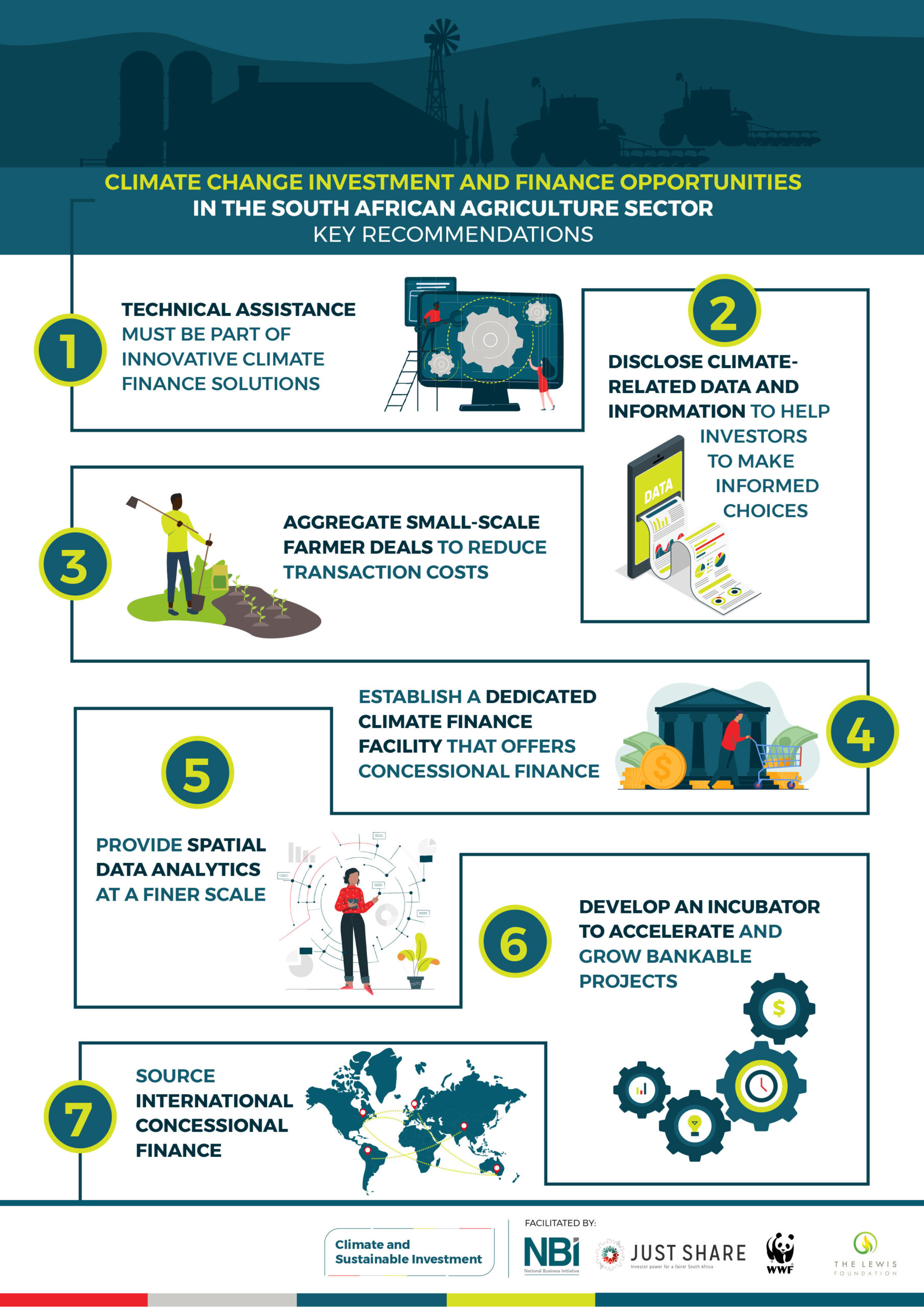

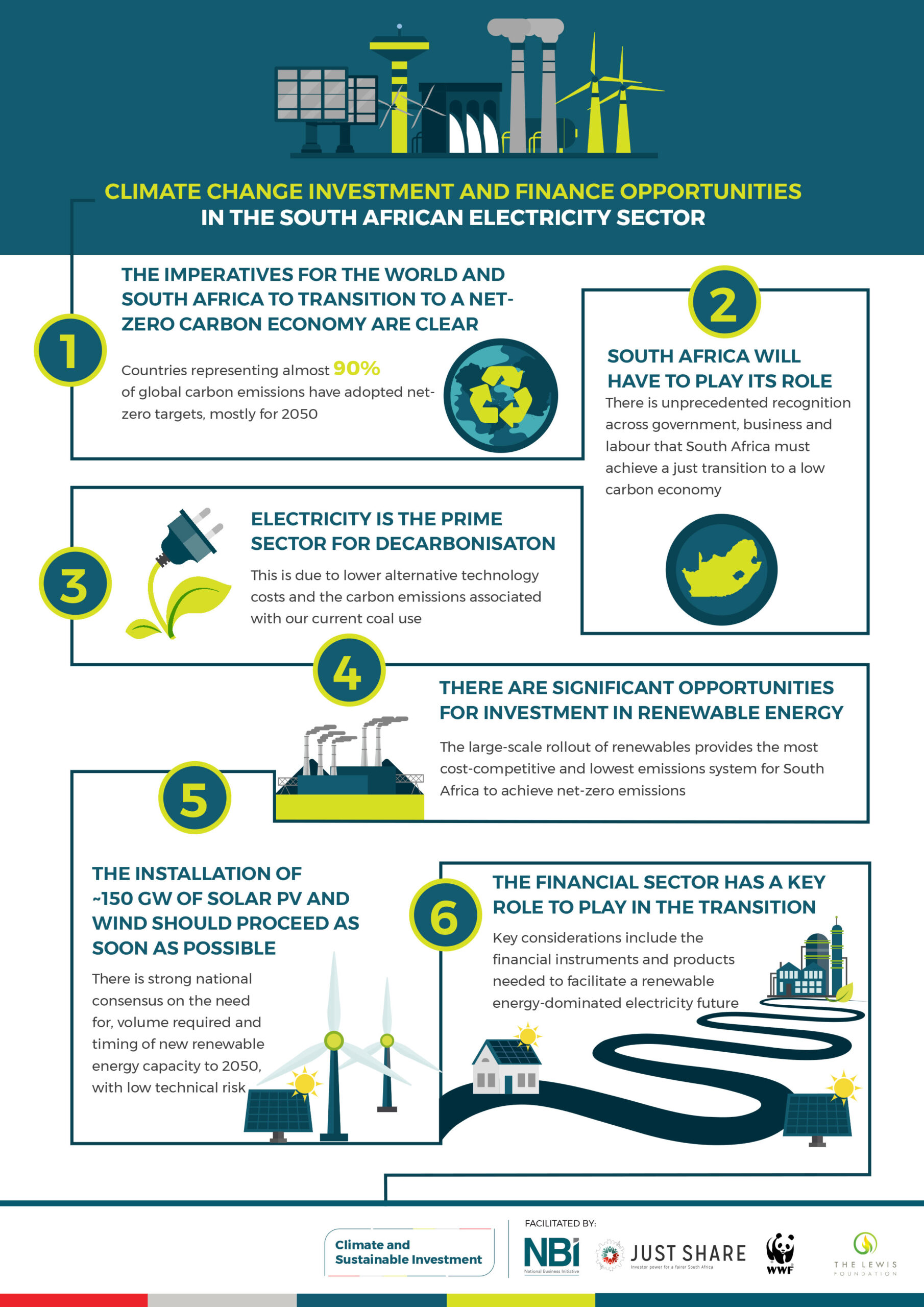

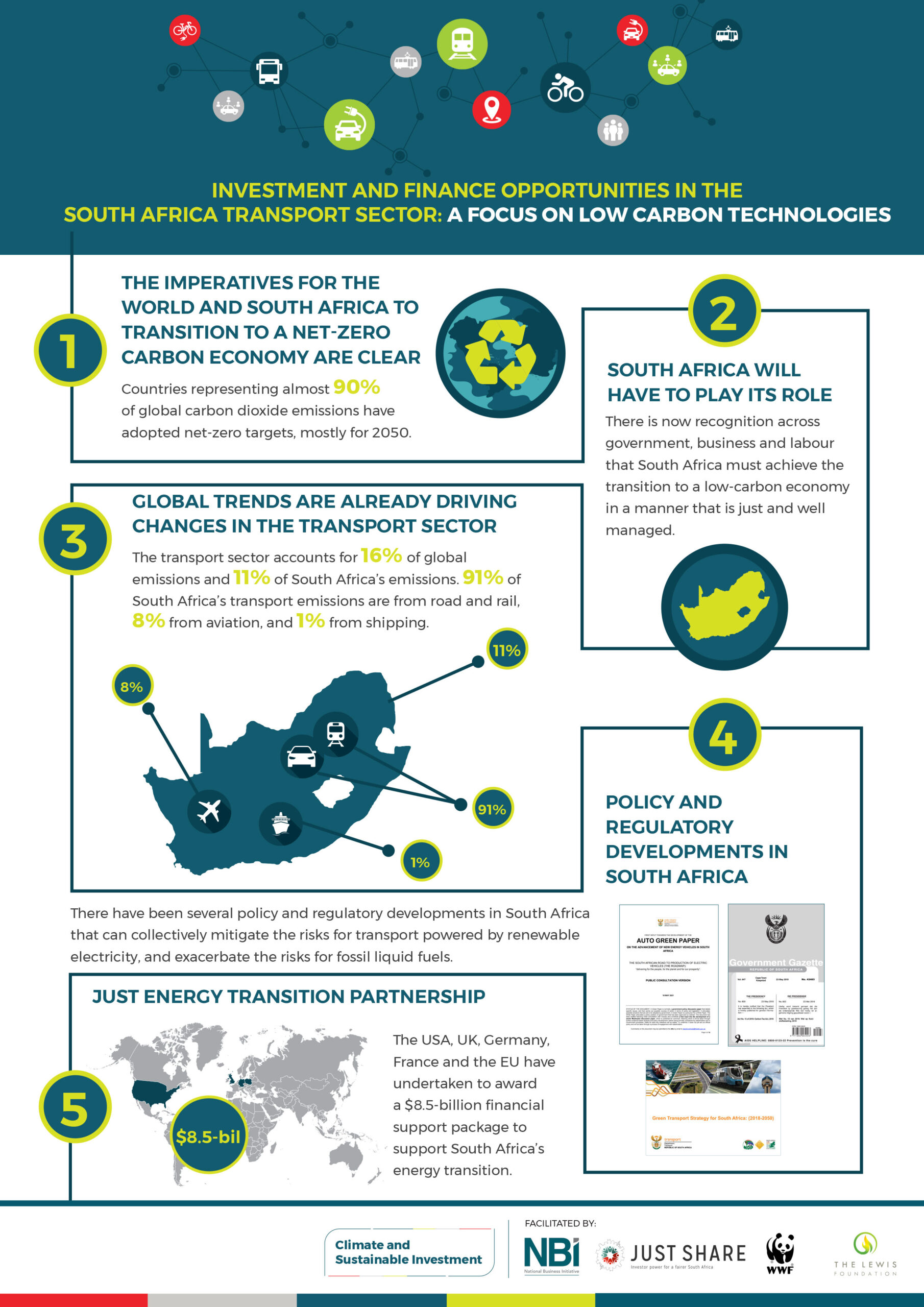

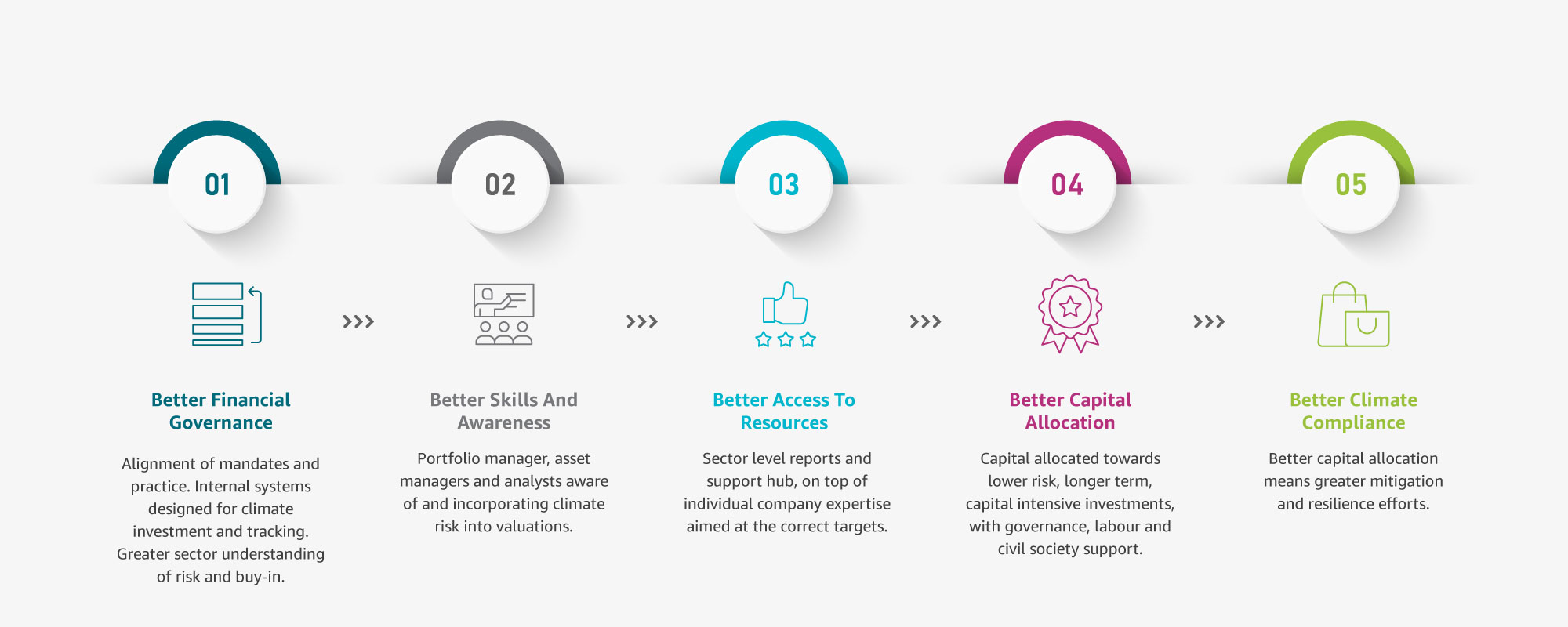

Completed in 2022 and based on a strong financial sector reference group, this project worked to build the capacity of the financial services sector to better understand and integrate climate risk into decision-making, in ways that drive climate action in South Africa forward. Detailed analyses for the electricity, agriculture and transport sectors were undertaken and are publicly accessible.

Introducing the Climate and Sustainable Investment Project’s Welcome Video

Our Goals:

Sector Insights

Climate & Sustainable Investment

Opinion Piece:

‘Financiers have a responsibility to fund the transition to a climate-resilient agricultural sector’ by John Hudson, National Head of Agriculture at Nedbank

Opinion Piece:

‘Investment in the transmission grid is critical for South Africa’s clean energy transition’ by Anton Eberhard – Emeritus Professor and Senior Scholar at the Power Futures Lab at the University of Cape Town’s Graduate School of Business